It’s about the future of AI products, and your career depends on getting this right.

I booked a flight to Porto and paid with Revolut Pay, here’s what actually happened.

Last week I booked a flight to Porto with TAP Portugal. Sunshine, seafood, and two full days of pretending I understand vinho verde. 🍷

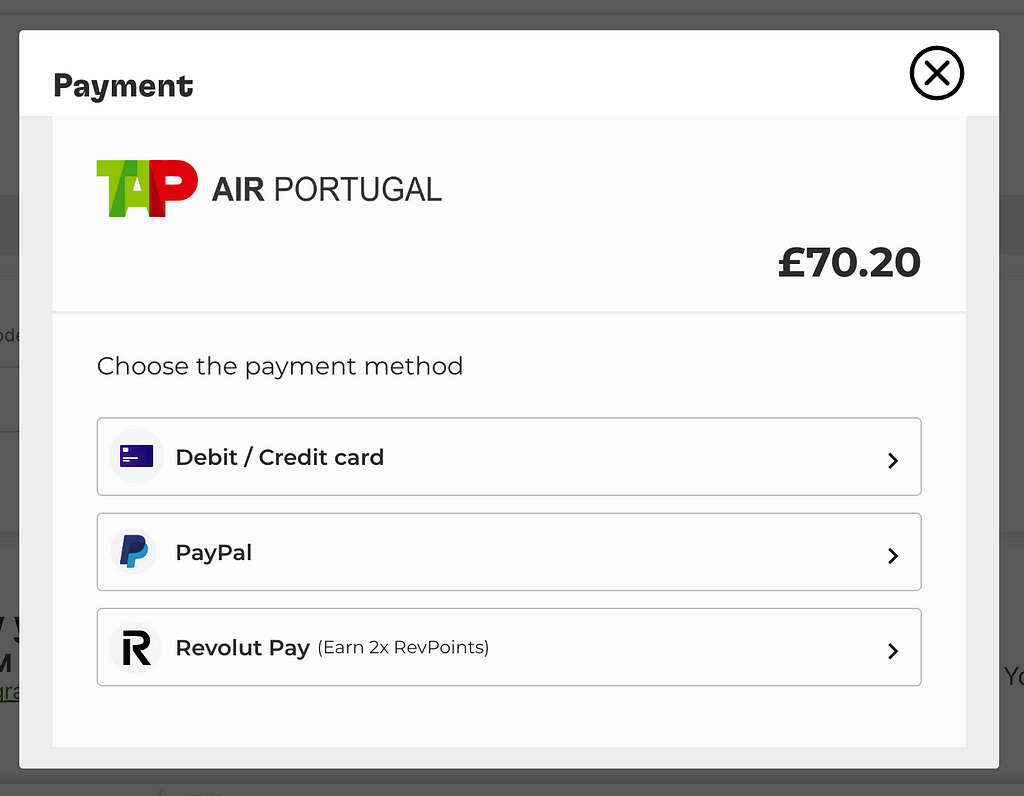

But right as I was checking out, something caught my eye:

Pay with Revolut Pay

Now, I’ve had a Revolut account since the “split-the-bill-on-holiday” days, back when the app was mostly currency exchange and passive-aggressive dinner math. But I’d never seen Revolut Pay front and center on an airline site.

So I tapped it.

And honestly? I walked away with a boarding pass, £7 off, and a better understanding of why Revolut is gunning for the top seat in fintech.

So… what is Revolut Pay, actually?

Think of it as Revolut’s Apple Pay. It’s a one-click checkout experience built on top of your existing Revolut account, no card details, no CVV limbo, no surprise redirects to a weird payment processor you don’t trust.

Here’s the flow:

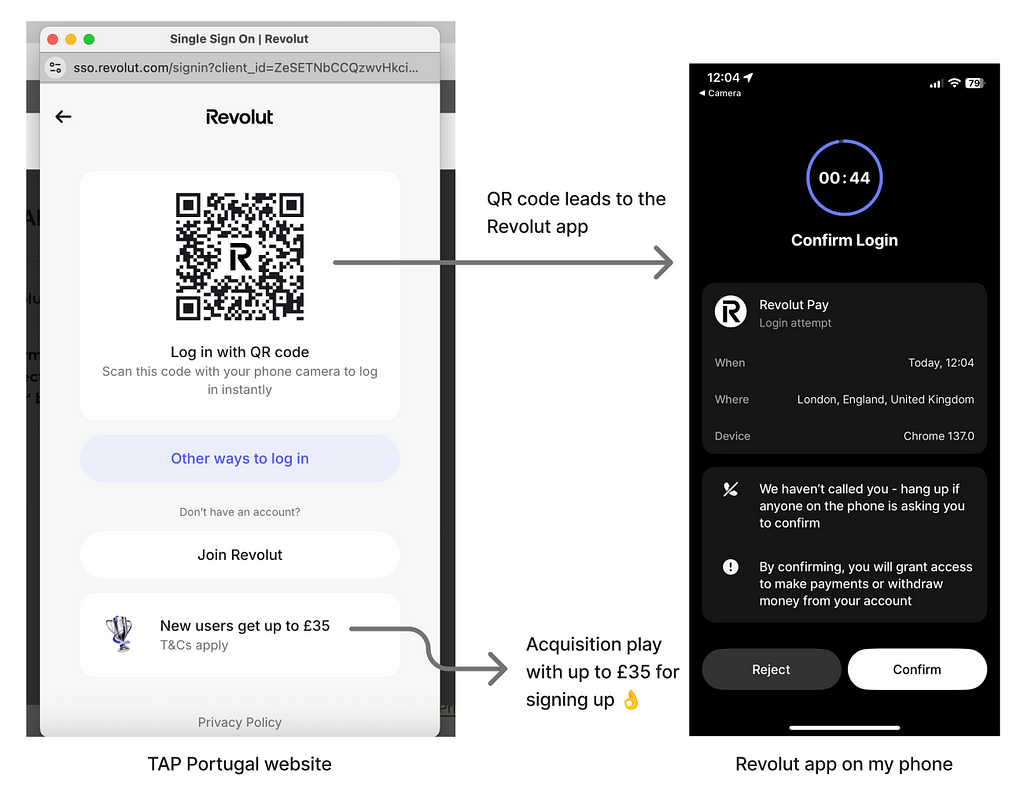

- I hit Revolut Pay on TAP Portugal’s checkout.

- It redirected me to a clean landing page with a QR code and two clear CTAs:

→ “Scan to pay” or

→ “New here? Get £35 for signing up.”

(Nice acquisition play. Subtle but smart.)

4. I scanned the QR. My Revolut app launched instantly: Face ID, done.

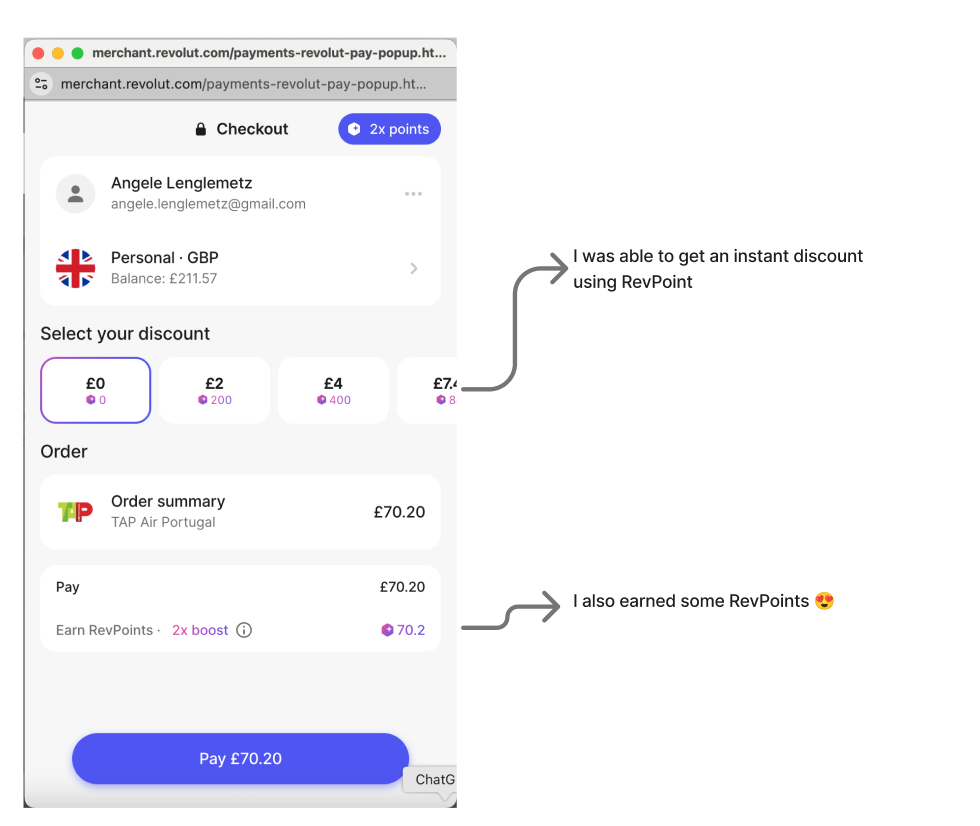

5. Then came the good stuff: I was offered a choice of discounts using my RevPoints:

- £0 off (lol) for 0 points

- £2 off for 200 RevPoints

- £4 off for 400

- …you get the idea.

I went for £7 off (700 RevPoints). One tap. Applied.

Bonus: because I paid £70 and had a double points promo running, I earned 70 RevPoints back on the spot.

Net-net: ✈️ cheaper flight, loyalty win, small dopamine spike.

And here’s the kicker: it didn’t feel like loyalty. It felt like money.

This is where most reward systems fall over, they make you feel like you’re racking up crypto dust you’ll never use.

But Revolut made the RevPoints visible at the moment of payment with no extra apps, no reward catalogue hell, just: “You’ve got value, want it?”

Obvioiusly, they are many things contributing to Revolut’s growth, but based on the number, there are doing something right.

Revolut now has 52 million users globally and £4 billion in annual revenue (that’s a 72% YoY increase).

The average Revolut Pay checkout has a 98.5% authorization rate and <10% cart abandonment.

Translation: people use it, it works, and it converts. It’s not just a better UX, it’s a legit growth lever.

What worked (and what others can learn from it)

Here’s what stood out from a product/growth lens:

- Zero-friction flow

Face ID -> Boom -> Done. No new cards, no data entry, no “where’s my wallet?” - Contextual rewards

I wasn’t asked to go use my RevPoints. They were surfaced in the moment, framed as a bonus. Behavioral gold. - Clear value exchange

I felt like I was getting something real (a £7 discount) for something passive (just being a Revolut user), that’s sticky.

What could improve

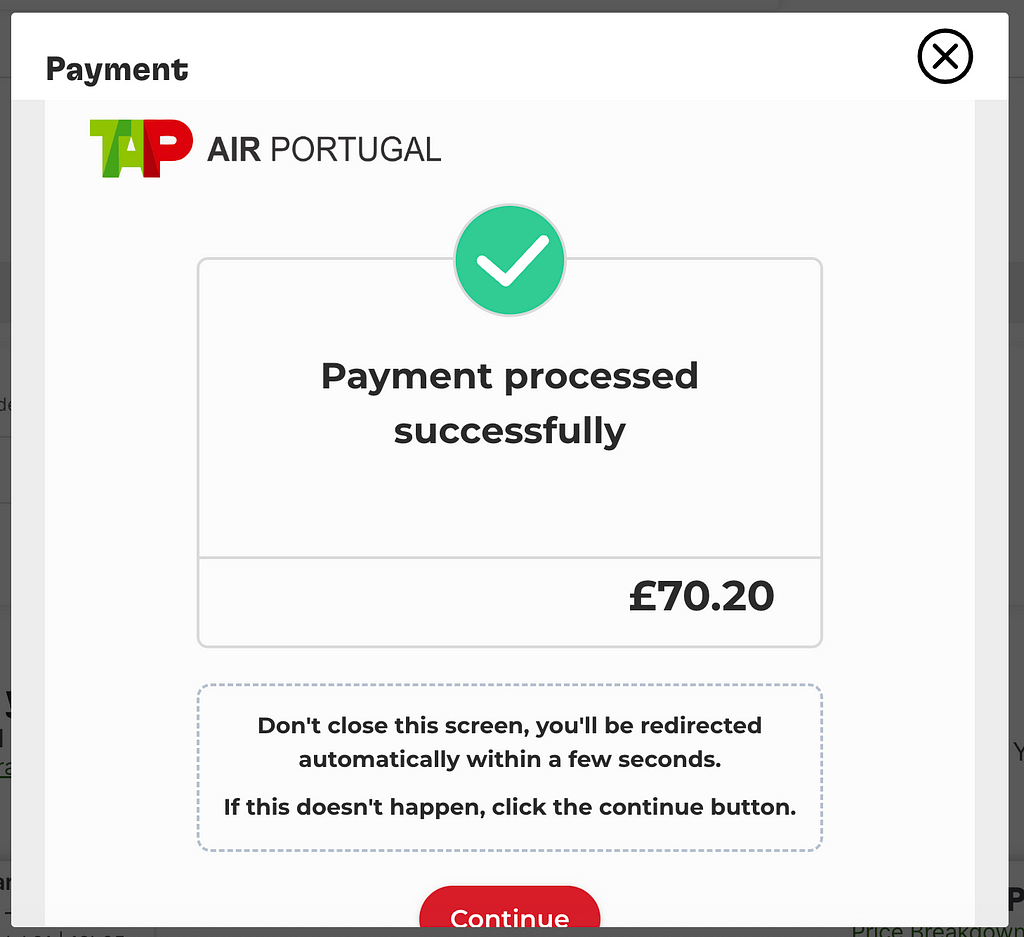

- The post-checkout dopamine hit was weak

There was no celebration, no “You saved £7!” banner. It’s a missed opportunity for reinforcement.

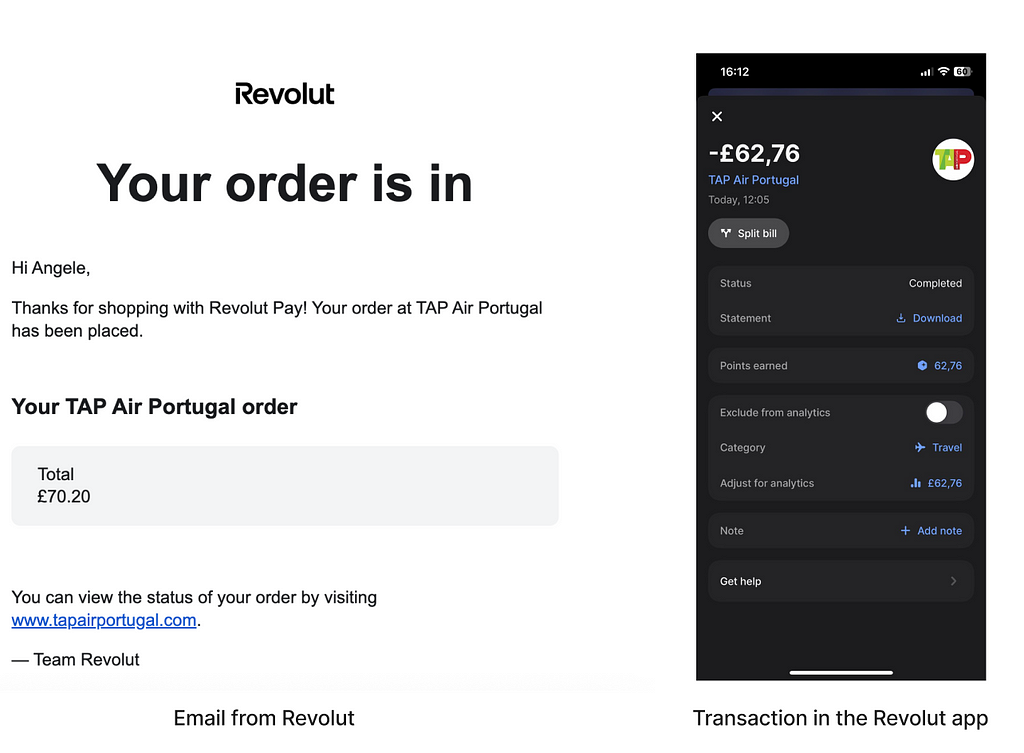

- Revolut email was also very dry and showed the wrong amount (I actually paid £62 instead of £70 thanks to the £7 RevPoints discount)

- Discovery still feels like luck

If I wasn’t already a Revolut user, I’d have skipped right past it. This is a classic B2B2C problem, merchants adopt a shiny new payment option, but the end user has no idea what it is.

When I saw the Revolut Pay option, there was a little line underneath: “2x RevPoints.” It’s a nice idea, but let’s be honest, if you’re not already a Revolut user, that might as well say “mystery reward, maybe?”

Why this actually matters

Revolut is no longer just a neobank. They’re quietly building a commerce layer, one where payment, rewards, and loyalty collapse into one smooth tap.

It’s strategic:

- They’re targeting travel (Aer Lingus and Wizz Air are already on board)

- They settle payments within 24 hours (big win for merchants)

- And they’re cheaper than Stripe or PayPal (ask any CFO what they want most)

Final thought

I came for a flight to Porto.

I left with a cleaner checkout, a surprise discount, and a better understanding of why Revolut’s not just a bank anymore, it’s a platform with an ecosystem.

It’s no accident they’re pulling in £1.4B in profit, serving 52M users, and quietly embedding themselves into how we spend.

So yeah. That £7 discount? It felt small. But it told a much bigger story.

The hidden growth machine in Revolut Pay was originally published in UX Collective on Medium, where people are continuing the conversation by highlighting and responding to this story.

Leave a Reply