Thirty-eight years since the launch of e-filing, the IRS will pilot its own tax filing system, ending two decades of Intuit’s regulatory capture of the tax software market

Last week, the Internal Revenue Service (US’ federal tax agency) announced that they are piloting a free, direct tax filing system in 2024. If your first reaction is “wait this didn’t exist before?”, that’s very justified. The US, arguably one of the technologically advanced countries in the world, has no government-provided system for e-filing of taxes today. If you are a taxpayer in the US, you have no choice but to use private software (like Intuit Turbotax) to pay your federal taxes. Even if your taxes are withheld by your employer, you still have to file “tax returns” through one of these products.

Tax is not the most interesting topic in the world, and I’m not going to go any deeper into it — however, the state of e-filing in the US is a fascinating story of how a handful of companies (well, primarily Intuit) leveraged lobbying to essentially stop the IRS from providing a free, direct tax filing system for decades. E-filing in the US first started in 1986 — thirty-eight years later, the IRS will pilot a direct tax filing system in 2024. While an incredible milestone, it might still be years before a fully operative free, direct tax filing system is open to the public.

This is a testament to the impact that decades of lobbying and regulatory capture can have on what is essentially a public utility. It took a series of explosive reporting from ProPublica in 2019 to change course, and if not for this reporting, the US would have signed into law fairly egregious legislation that prohibits the IRS from ever building its own filing tool. In this article, we’ll dive into:

- Intuit’s biggest “competitor” (spoiler: it’s the IRS)

- IRS Free File but not free for all

- The battle among “free” products

- Cracks in regulatory capture and how IRS Direct Filing came to be

Intuit’s biggest “competitor”

Before going into the story of how this played out to be, let’s start with a quick analysis of Intuit’s arguments for why a free, direct filing system provided by the IRS is bad for the people — I say quick because their arguments are self-serving and do not hold up to much rigor. Intuit contends that:

- Government-run tax preparation creates a conflict of interest — This is a reasonable argument. The IRS being the tax collector and preparer of returns could put taxpayers at a disadvantage since the IRS isn’t incentivized to reduce taxes. However, the IRS has repeatedly taken the position that their goal is provide a free, direct filing tool that is one of many tools in the continuum from self free-file, to paid filing products, to hiring a tax professional.

- IRS audits lower-income taxpayers more than rich people, and therefore IRS’ reach should not be expanded — Again, this is a fair argument at face value and Intuit points to several studies that show that the IRS does not go aggressively enough after rich people. But by providing a free tool, the IRS is not taking choice away from taxpayers, only providing them another alternative in the continuum of tools.

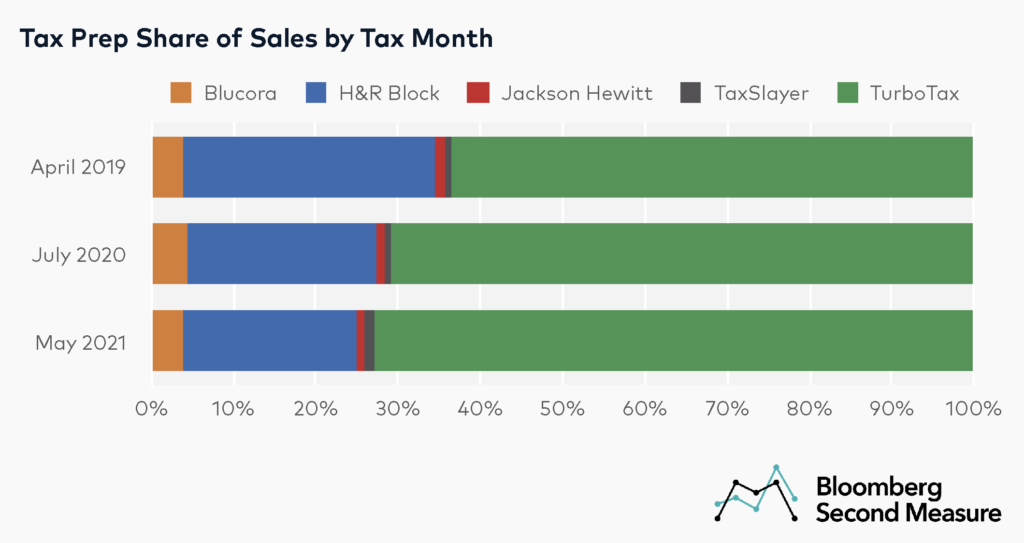

The real argument, which Intuit doesn’t make publicly anymore, is a simple one. Intuit Turbotax’s biggest competitor is not another tax software company (H&R block is a distant second). TurboTax’s biggest competitor is the IRS — if the IRS were to create a free, direct filing system, it would have an outsized negative impact on the tax filing software market.

This is the big threat that Intuit has systematically and successfully managed to mitigate for decades (this ProPublica piece has comprehensive coverage on the topic). Let’s talk through how.

Intuit’s journey with tax filing software started in 1993 with the $225M purchase of Chipsoft, the maker of TurboTax. The initial version of TurboTax was distributed on disks and was the popular option for e-filing back then, and soon Intuit knew that TurboTax needed to go online. But so did lawmakers and thus came the push for the IRS to double down on electronic filing.

To deal with this, Intuit hired a former AT&T lobbyist. The success from this was quick and manifested as the Restructuring and Reform Act of 1998. This law had a series of carefully crafted concessions in Intuit’s favor:

The Internal Revenue Service should cooperate with and encourage the private sector by encouraging competition to increase electronic filing of such returns

the Secretary of the Treasury shall establish a plan to eliminate barriers, provide incentives, and use competitive market forces to increase electronic filing gradually over the next 10 years

Electronic commerce advisory group — To ensure that the Secretary receives input from the private sector in the development and implementation of the plan

In other words, the new law signed by Congress was instructing the IRS to collaborate with the private sector (read: play ball with them), and in the case of conflicts, receive inputs from an advisory group that included representatives from the large tax filing software companies.

This bought Intuit some relief for a few years but by 2002, the company faced another challenge. The Bush administration was calling on the IRS to develop a free, direct tax filing system. In response to this, Intuit activated its lobbying machine to get several lawmakers to argue that there was no reason for the government to “compete with well-established private tax prep companies”, internally dubbed by Intuit as government “encroachment”. The IRS, caught in the middle, agreed to what in hindsight was a terrible middle ground called the IRS Free File program.

IRS Free File but not free for all

The premise of the IRS Free File program was relatively simple. The IRS had two constraints: 1) did not want to get caught in the crossfire between lobbyists and the Bush administration, and 2) they were concerned that they would not be able to provide the customer support required if they built their own software. So they asked themselves: how can we get lower-income taxpayers free filing but also maintain a market for tax prep companies?

A coalition of tax prep companies called the Free File Alliance, led by Intuit, agreed to provide free federal filing to 60% of taxpayers. This sounds like a great deal on paper but if you look at the terms of the agreement, it becomes clear quickly why this was a terrible deal for the IRS to sign:

- Each company could set its own requirements for who is eligible for Free File

- Only federal tax filing was required to be free, state tax filing can be separate and paid (only 9 states in the US do not have state income tax, i.e. everybody else needs to file federal AND state taxes)

- Each company individually only had to cover 10% of taxpayers under Free File

- Free File offers will be listed on a special page of the IRS website, but companies are not obligated to publicize this free alternative to their existing products

This worked well for Intuit for a while. Intuit managed to keep their paid tax prep software business healthy while framing Free File offers in a way that limits adoption. For example, the eligibility description of their page was difficult to understand: you can use Free File “if you are eligible for EIC, are age 22 or younger, age 62 or older, or active Military with a W2”.

Then in 1998 came a scrappy competitor TaxAct, which offered free filing to all with no restrictions, and only monetized through extra services beyond filing. This forced Intuit and H&R Block to also offer unrestricted free filing, and in 2005, 5M people in the US filed taxes through the Free File program.

This of course posed a major threat to Intuit’s business, and Intuit started activating its lobbying machine again. Intuit argued that the Free File program was meant to service disadvantaged taxpayers and had “drifted very far from its original public service purpose and objective”, and the IRS was sympathetic to the argument.

Let that seep in for a second. A company that is built on friction that exists in a government process successfully convinced a federal agency to keep the friction so that the company’s business is not hurt. No subtle arguments, no consumer welfare arguments, no market competition arguments — straight up “this increased competition in the market is hurting us, help us maintain our business”, and the IRS agreed to help.

It gets better. The IRS writes to the Justice Department asking if it’s okay for one of the Alliance members (Intuit) to restrict other members from providing a free product. A federal agency, that works for the taxpayer, is asking its lawyers if it’s okay to help a private company engage in anti-competitive conduct because lesser friction for the taxpayer is hurting the private company’s business.

Now the cherry on top. The Justice Department, in a May 2005 letter responds saying that price fixing would likely constitute antitrust behavior but here is an alternative — if the IRS itself were to impose such a restriction, it would be legal (to be fair, I don’t blame the DOJ for this — a lawyer’s obligation is to provide advice to their clients, but it obviously is egregious).

That’s exactly what the IRS did — the Free File program on the IRS website was now explicitly limited to lower income taxpayers even if a company was willing to open it up for all:

One major concern was the overall health of the online and self-prepared market segment. In 2005, 75% of the e-file growth in this segment could be attributed to the Free File program. If this trend continues, the IRS was concerned that it could cause many vendors to go out of business.

In order to maintain the viability of the free file program, IRS proposed to limited companies to income ranges that represent 70–75% or less of the individual taxpayer population

IRS Free File was now forcefully not free for all anymore, which opened up the next wave of competition in this artificially constrained market.

The battle among “free” products

TaxAct, having seen the success from advertising “free” filing, decided to take the fight to its own website — they couldn’t offer Free File on the IRS’ website but they could offer on their own. So, TaxAct started offering free filing to all consumers on their own website.

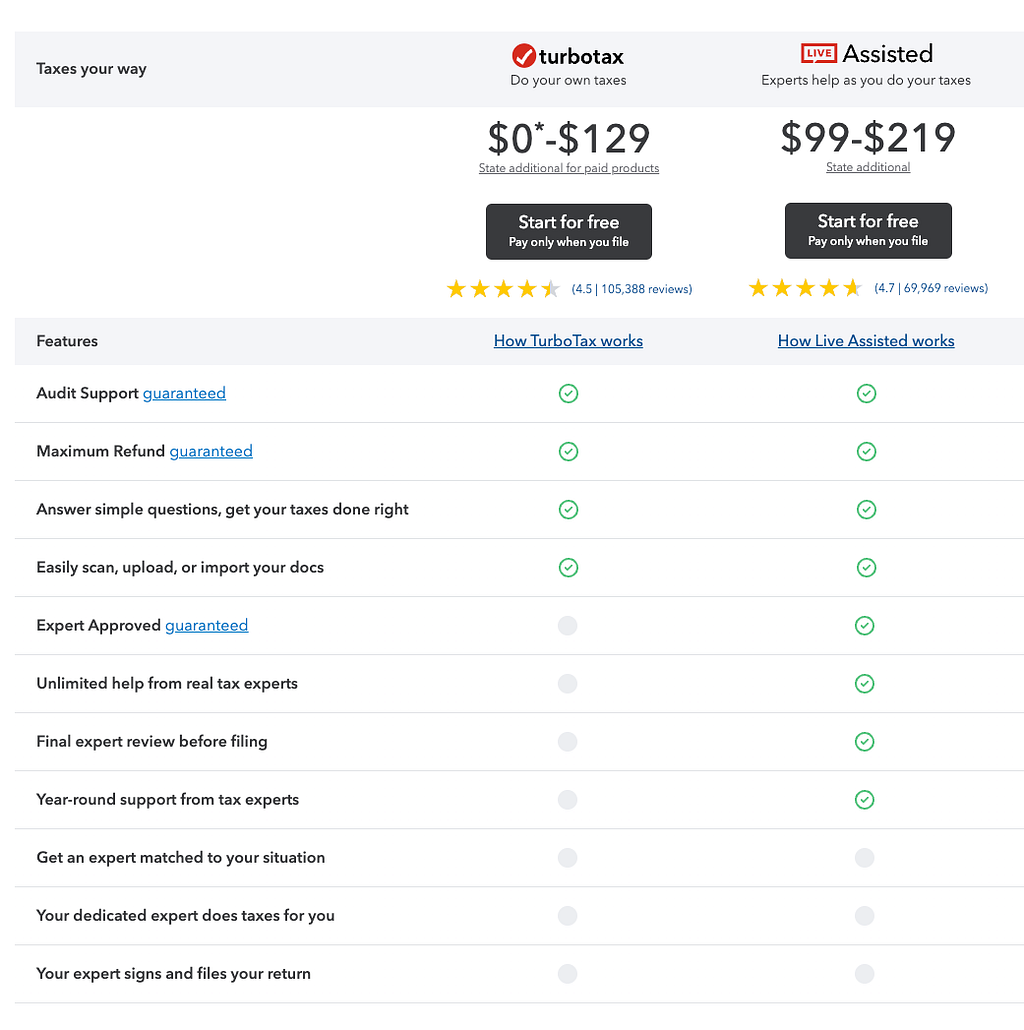

Intuit responded by launching “TurboTax Free Edition” on its own website. Note that this is different from “IRS Free File by Turbotax” which is the IRS-mandated free version. So, now a consumer when looking for a free Intuit product was faced with a confusing choice of two seemingly free products.

However, Intuit pursued several strategic growth hacks to turn the TurboTax Free Edition (not the IRS-mandated version) into essentially a not-free-most-of-the-time product. Some of their efforts included:

- SEO and search ads optimized for “free” searches with multiple mentions of “free” in the copy

- Pitches for extra products like “Audit Defense”

- Paywalls placed much later into the filing process so taxpayers (who often file last minute) suck it up and pay, rather than abandon and start over elsewhere

- Simple forms placed behind paywalls (eg. ProPublica documents the user flow for a house cleaner and a Walgreens cashier who were both shown paywalls because forms for independent contractors are not included in the free product)

- De-indexing the IRS Free File program from Google Search so that the only way to reach this page is from the IRS website

I’ll concede that some of these are not objectively bad. For example, upselling products or optimizing SEO copy to get people in the door are fairly standard “growth hacking” practices. Whether you think they are ethical or not, most companies have to do this, at least to defend their market share. But the rest could be construed as unlawful and / or deceptive, and as you’ll see in a minute, the FTC eventually declared many of these practices as deceptive marketing.

Cracks in regulatory capture and how IRS Direct Filing came to be

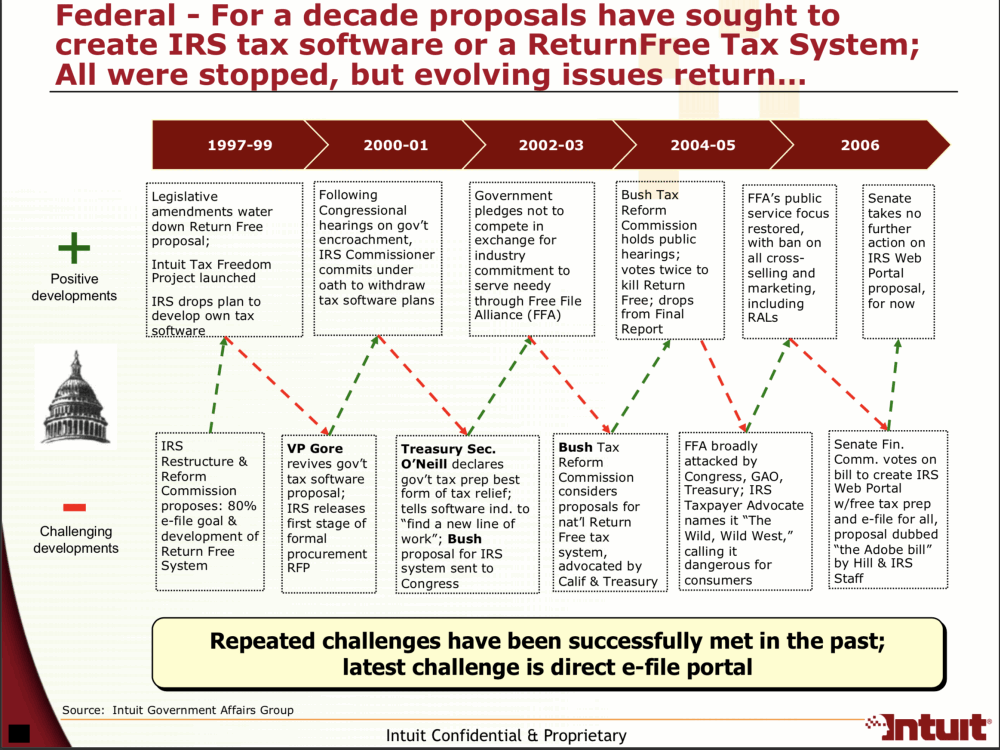

I’m going to skip a few years of history in the middle but what’s useful to know is that Intuit has gone through a cycle of attacks on their regulatory capture multiple times over 20 years. Almost all of the times, they have managed to successfully lobby their way to success. This slide published by ProPublica (acquired from an internal Intuit board of directors meeting) articulates the ups and downs:

After two decades of success, cracks finally started appearing. In July 2018, a UC Davis Law Professor who was also part of the IRS Advisory Council wrote a scathing op-ed about the Free File program. He argued that the program had failed across multiple dimensions (extent of adoption, companies engaged in deceptive practices, free-to-fee plays), and also criticized the Taxpayer First Act which was slated to be passed in the Senate (we’ll talk about this more in a second).

This was followed by a harsh evaluation report submitted by the IRS Advisory Council in November 2018, declaring that “The IRS’s deficient oversight and performance standards for the Free File program put vulnerable taxpayers at risk”.

It’s worthwhile to zoom in on the Taxpayer First Act for a second — this was a law intended to make significant reforms to the IRS. Included in the bill was a clause that can have no other explanation than be the consequence of lobbying. This clause would have made the Free File program permanent and stopped the IRS from EVER creating their direct filing program. This bill, with the Free File permanence clause, was actually passed in the House and was pending a vote in the Senate. Intuit was so close to their finish line of regulatory capture — this would have been Intuit’s permanent trophy as a reward for two decades of lobbying. The only reason this didn’t pass was ProPublica’s reporting.

In 2019, ProPublica published a series of articles exposing Intuit’s practices and twenty years of regulatory capture. This, along with the IRS Advisory Council report, were the two most seminal pieces of work that broke Intuit’s regulatory control. Both of these together laid out the foundational work for reeling Intuit in.

The dominoes started falling pretty quickly from there. In December 2019, the IRS announced the signing of a New Free File agreement with several notable improvements. Free File Alliance members:

Will not exclude their Free File Landing page from an organic internet search.

Will ensure a link on their sites is available to return taxpayers to the IRS Free File website at the earliest feasible point in the preparation process if they do not qualify for the Member’s Free File offer, and

Will regularly survey taxpayers who successfully e-filed a tax return through the Free File program, reporting their results quarterly to the IRS

Immediately after, Intuit put out a press release about how they strongly support these changes, and unsurprisingly in July 2021, Intuit withdrew from the Free File program (as did H&R Block).

In May 2022, Intuit settled a deceptive advertising suit agreeing to pay $141M to customers across the US who were deceived by misleading ads for free tax filing. The company also agreed to suspend its “free, free, free” ad campaign. The suit again, was triggered as a consequence of ProPublica’s reporting.

Since then, the FTC has gone after Intuit for deceptive advertising, and last month made an administrative ruling that Intuit indeed did engage in deceptive advertising. Intuit has said they will appeal the decision (note that the FTC is an enforcer and it’s up to the courts to determine if they’ll hold or overturn FTC’s ruling).

And this sequence of events resulted in last week’s announcement that the IRS will pilot free, direct tax filing in 2024 (note that this was funded by a $15M allocation in the 2022 Inflation Reduction Act).

Conclusion

I have to say I have somewhat mixed emotions writing (or rather recapping) this story. A few thoughts.

Firstly, I’m appalled by this history of regulatory capture. I was generally aware of this story broadly but the ProPublica pieces were eye-opening. I believe both in the power of capitalism to move the world forward and in the need for regulation as guardrails, so it’s disappointing to see that this level of blatant regulatory capture is possible.

That said, it makes me optimistic that there are balancing forces — investigative publications like ProPublica, the IRS Advisory Council that finally wrote the harsh critique, and even just populist sentiments which might have triggered the deceptive advertising lawsuit and the $15M funding in the Inflation Reduction Act.

Secondly, it reinforces my belief in mechanisms-based regulation. We have talked about this concept in the context of DOJ v. Google and AI regulation, and this story reinforces why brute force regulation that’s targeted at certain companies (for or against) does not hold up well over time. It doesn’t just disrupt free market forces / slow down capitalism but often has the opposite effect (as in the case of Intuit).

Thirdly, I have interacted with multiple friends / colleagues who work or have worked for Intuit, and I have an incredible amount of respect for them. While I absolutely think Intuit engaged in regulatory capture which was a net negative for taxpayers, most of the Intuit folks I’ve interacted with personally have been high integrity, decent and competent people. And that’s a duality I’m okay to maintain in my head.

🚀 If you liked this piece, consider subscribing to my weekly newsletter Unpacked. Every week, I publish one deep-dive analysis on a current tech topic / product strategy in the form of a 10-minute read. Best, Viggy.

Direct tax filing: is this the end of Intuit’s lobbying? was originally published in UX Collective on Medium, where people are continuing the conversation by highlighting and responding to this story.

Leave a Reply